- Monthly expenses template full#

- Monthly expenses template android#

- Monthly expenses template software#

Monthly expenses template full#

Full payment is charged to your card immediately. Purchase entitles you to Quicken for the term of your membership (depending upon length of membership purchased), starting at purchase.The App is a companion app and will work only with Quicken 2015 and above desktop products. Not all Quicken desktop features are available in the App.

Monthly expenses template android#

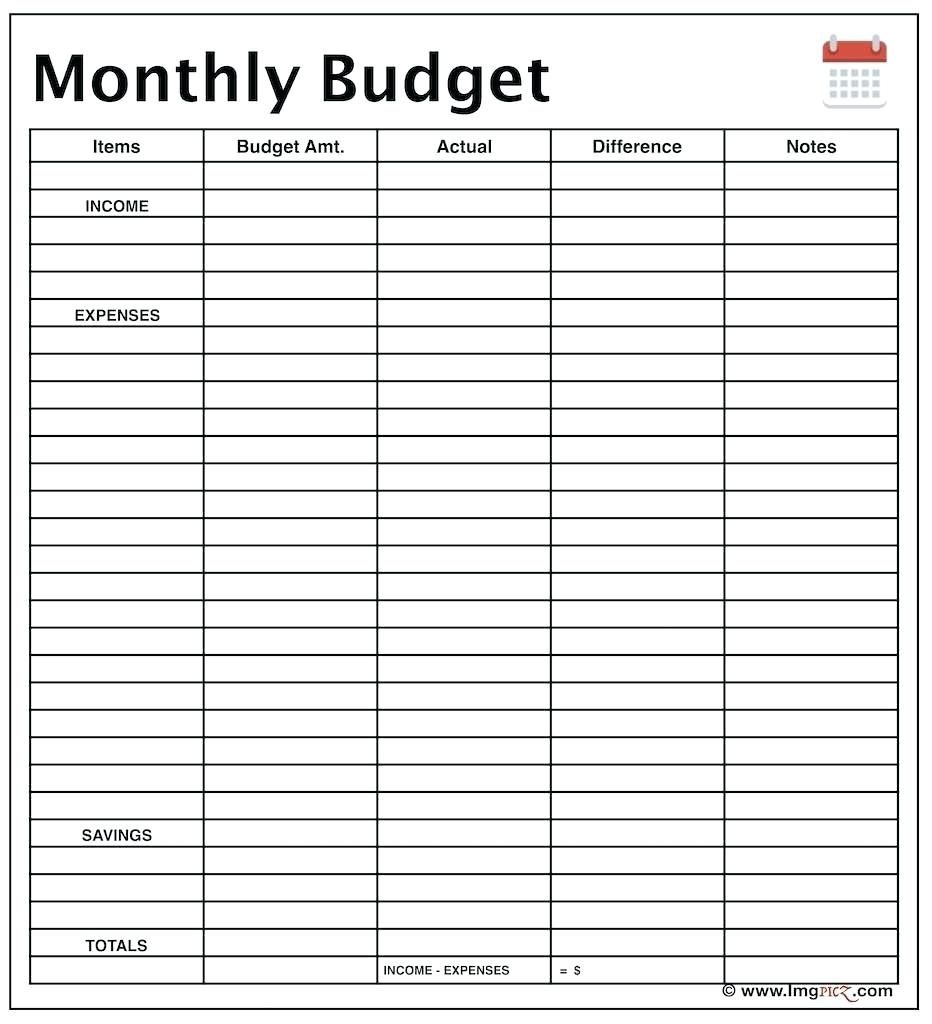

Quicken App is compatible with iPad, iPhone, iPod Touch, Android phones and tablets. Standard message and data rates may apply for sync, e-mail and text alerts.14,500+ participating financial institutions as of October 1, 2018. Phone support, online features, and other services vary and are subject to change. Third-party terms and additional fees may apply. Monitoring alerts, data downloads, and feature updates are available through the end of your membership term.These offers cannot be combined with any other offers. † Limited time offers apply only to the purchase of Quicken Deluxe, Premier, or Home & Business for the first year and only when you order directly from Quicken by September 30, 2023, 11:59 PM PST. Use this tool to review your budget regularly and adjust it as needed to keep a firm grasp on your personal finances. As you continue to enter your expenses into Quicken Starter Edition, it tells you how your current expenses compare to the budget you have set. For example, if you find that you are spending 20 percent of your income on restaurants, this might be a good category to start cutting down.

You can use these numbers as a rough guide for your own budget.

Medium goals include eliminating credit card debt or having enough saved to take a family vacation. The first step Stein-Smith suggests is to "make a plan for your short, medium and long-term goals." For example, short-term goals include ensuring that your expenses don't exceed your income or beginning a systematic savings plan. To help get you started, Sean Stein-Smith, a New Jersey-based CPA, CGMA and member of the AICPA’s National CPA Financial Literacy Commission, recommends a five-point plan for tracking your monthly expenses.

Monthly expenses template software#

Simply start by entering your monthly transactions - the software tracks your budget automatically. The budget tools in Quicken Starter Edition make creating a budget a breeze. By knowing exactly how much cash you have coming in, you can take control of your money and direct it to where you most need it. A monthly budget is a fundamental tool for understanding your household finances.

0 kommentar(er)

0 kommentar(er)